Can impact investing in tropical forests improve rural livelihoods and reduce deforestation pressure? An assessment of two case studies in Acre, Brazil

Can impact investing in tropical forests improve rural livelihoods and reduce deforestation pressure? An assessment of two case studies in Acre, Brazil

Christopher Martin, MF–MBA1

Abstract

Acre Aves and Dom Porquito are animal protein production companies in the state of Acre Brazil. They both received impact investments from Kaeté Investimentos, a São Paulo-based impact investment manager focused on the Brazilian Amazon. Acre Aves and Dom Porquito employ an impact-mode that integrates rural landowners into their supply chains, with the intent of increasing rural incomes and reducing deforestation pressure. Initial results suggest that both companies have strong social impact, as producers integrated into company supply chains were found to have increased overall quality of life, increased income/purchasing power, and more financial stability. Results suggest Acre Aves and Dom Porquito have moderate and weak environmental impacts, respectively. Although the companies’ producers reduced the use of unsustainable slash-and-burn agriculture, they were also found to have increased the size of their cattle herds. The results challenge the assumption that intensification of productive activities provides a solution to reduce deforestation in the Amazon. However, they also suggest the model employed by Acre Aves and Dom Porquito provides a sustainable alternative to the Brazilian Amazon’s cattle-based economy.

Acre Aves e Dom Porquito são empresas de produção de proteína animal no estado do Acre Brasil. Ambos receberam investimentos de impacto da Kaeté Investimentos, uma gestora de investimentos de impacto com sede em São Paulo, focada na Amazônia brasileira. Acre Aves e Dom Porquito empregam um modo de impacto que integra os proprietários rurais em suas cadeias de fornecimento, com a intenção de aumentar a renda rural e reduzir a pressão de desmatamento. Os resultados iniciais sugerem que ambas as empresas têm um forte impacto social, uma vez que os produtores integrados nas cadeias de fornecimento da empresa apresentaram maior qualidade de vida, aumento da renda/poder de compra e mais estabilidade financeira. Os resultados sugerem que o Acre Aves e Dom Porquito têm impactos ambientais moderados e fracos, respectivamente. Embora os produtores das empresas tenham reduzido o uso de agricultura insustentável de derrubada e queimada, eles também aumentaram o tamanho de seus rebanhos bovinos. Os resultados desafiam a suposição de que a intensificação das atividades produtivas fornece uma solução para reduzir o desmatamento na Amazônia. No entanto, eles também sugerem que o modelo empregado pelo Acre Aves e Dom Porquito fornece uma alternativa sustentável para a economia baseada na pecuária da Amazônia brasileira.

Introduction

The world’s tropical forests provide vitally important ecosystem services including climatic regulation, biodiversity maintenance, and hydrologic cycle regulation, among others (Bonan 2008). However, tropical forests continue to face significant pressure and threats of deforestation and/or degradation (Sloan and Sayer 2015), and suffer losses in area of approximately 6.8 million hectares annually (FAO and JRC 2012).

While most biodiversity conservation strategies prioritize deforestation reduction (Nepstad et al. 2009, Soares-Filho et al. 2006, CBD 2018), there exists a significant gap in the funding needed and the funding available for conservation around the world. While global annual funding for conservation is estimated to be approximately $50bn (Parker et al. 2012), the need is estimated to be between $300–$400bn (Huwyler et al. 2014). Many point to market-based strategies such as impact investing as a means to address this gap. Impact investing is investing in companies, projects, and funds with the objective of generating positive social and/or environmental outcomes alongside financial gains (GIIN 2018). It may help to solve pressing conservation challenges by attracting new sources of financing, while also providing returns to investors (Clark 2007, Huwyler et al. 2014, NatureVest & Eko Asset Management Partners 2014). However, the field of impact investing is still incipient, and more research is needed to evaluate the potential conservation benefits it may offer.

The rise of impact investing in recent years has failed to provide many relevant examples in regions dominated by tropical forests. However, one noteworthy exception is the Amazonian Sustainable Enterprise Investment Fund (FIP Amazônia). FIP Amazônia is a private equity fund 80% capitalized by the Brazilian National Development Bank and managed by São-Paulo based investment manager Kaeté Investimentos (Kaeté). As the world’s only fund 100% dedicated to impact investing in the Amazon, FIP Amazônia stood out as an ideal partner for research focused on impact investing in tropical forests. FIP Amazônia has focused the majority of its investments in the state of Acre in northwestern Brazil, as the state government’s pro-sustainable development platform has led to an environment relatively rich in sustainable enterprise (Rêgo 2015).

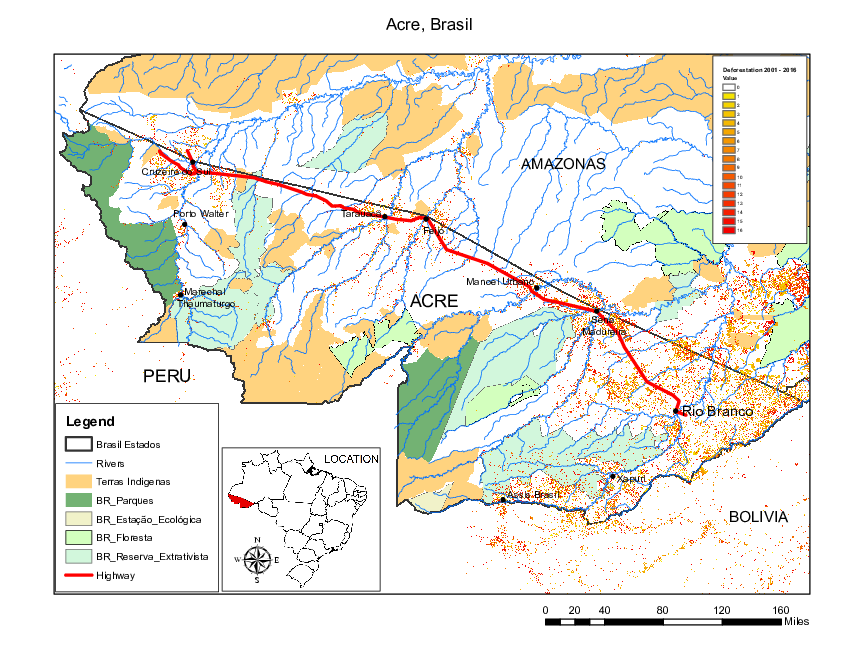

The state of Acre (Figure 1) has a population of slightly over 800,000 and a land mass of about 1.16 million km2 (O Governo do Estado do Acre 2018). Acre is a relatively poor state, with its annual per-capita GDP of R$12,690 (about US$3600) ranking number 19 of Brazil’s 27 states (Chepkemoi 2017). It does not have the best conditions for agriculture or cattle ranching, particularly due to its predominantly highly-weathered, acidic ultisols (Watling et al. 2017). Such soils are largely lacking in plant nutrients, and farmers must typically rely on slash-and-burn agriculture (Sanchez et al. 1982), making larger scale sustainable agricultural management more challenging. Since the state’s pro-environmental government came to power in 1999, deforestation fell from 547 km2 yr-1 in 2000 to 264 km2 yr-1 in 2015 (O Governo do Estado do Acre 2018). Furthermore, Protected Areas cover 45.84% of the state’s land mass and forest cover remains high at 83% (O Governo do Estado do Acre 2018).

The two investments assessed for the present study were made in animal protein-production companies Acre Aves (AA) and Dom Porquito (DP), which began operations in Acre in 2009 and 2016, respectively. AA produces chicken and DP produces pork, and both integrate low-income, and small- and medium-sized rural landowners into their supply chains. Both companies are public-private initiatives (AA is also partially owned by a cooperative representing the rural community). Start-up costs were funded by the government of Acre and local entrepreneurs. Furthermore, the state government invested heavily in developing the state’s productive base. It partially financed the barns used by producers to fatten chickens and pigs in AA and DP’s supply chains, and provided access to lines of credit for the producers to take out low interest rate loans to finance the remaining portion. In the case of AA, many producers chose to take out additional loans within several years of starting to raise chickens to build newer and larger barns to expand their production.

A description of the supply chain model employed by AA functions is as follows:

-

AA produces chicks in a state-of-the-art incubation facility that it built, owns, and manages.

-

AA distributes chicks to approximately 45 “integrated producers,” rural landowners under contract to raise chickens for AA.

-

The rural producers raise the chickens in highly efficient, self-contained chicken barns. AA provides the producers with all the necessary medication and chicken feed (all of which is produced in AA’s feed mill), as well as technical assistance.

-

After 45 days, the chickens have an average weight of about 2.3 kilograms. AA collects them from the producers and slaughters and processes them in its slaughterhouse, before bringing them to market.

-

As mentioned above, the producers are known as integrated producers. They do not pay for the chicks, feed, medication, technical assistance, or transport. Likewise, AA does not purchase the fattened chickens, but compensates the integrated producers for their services and for the use of their chicken barn. Compensation varies based on how well the producers are able to fatten the chickens. The higher the average weight of the chickens, and the higher the number of chickens that survived, the better compensation the producers receive2.

The theory of change behind this model rests on the fact that it provides rural landowners with an intensive production system requiring a small land area. This is meant to replace extensive, low-intensity production systems requiring large area, such as cattle ranching, which is responsible for 4/5 of Amazon deforestation (Nepstad et al. 2009). This is meant to drive positive social impact by increasing and diversifying income for rural landowners. In turn, this should reduce deforestation pressure from rural landowners, who should be able to increase their income through expansion of intensive animal barns instead of extensive pasture, driving positive environmental impacts.

The goal of this research was to assess this theory of change by measuring the environmental and social performance of AA and DP’s supply chains. More broadly, there have been few instances of impact investing in tropical forests, and even less research carried out on the subject. This research attempts to shed light on the potential benefits impact investing may hold for tropical forest conservation by observing results from the concrete examples seen in these two companies.

Materials and methods

Choice of impact investment company

As described in the introduction, there are few impact investments that have been made in the Amazon basin or in other tropical forests. FIP Amazônia was chosen to be the subject of the research because it is the only investment fund fully dedicated to impact investing in the Amazon. Of the four major investments made to date, three were made in the state of Acre, which made Acre the obvious research site choice. One of the three investments was made in Peixes da Amazônia, a fish company that employs a similar model to AA and DP. It was excluded from the present study for various reasons, including that a lack of working capital has kept the company at a near “pre-operational” level and its producers do not interact as consistently with the company and are not fully integrated into its supply chain.

Data collection and interviews

Research and data collection was carried out in Brazil in September–November of 2017. The first and preliminary phase took place in Kaeté’s São Paulo headquarters, and consisted of secondary research and semi-structured interviews of Kaeté staff. The purpose of this phase was to gain familiarity with Kaeté’s investment model and investments in AA and DP. The second phase took place in the state of Acre. Several weeks were spent gaining familiarity with Acre and its sustainable development agenda, by speaking with NGO staff and government employees and participant observation of several sustainable enterprises. Next, a better understanding of AA and DP was developed by speaking with executives and staff as well as participant observation of all company processing facilities. Finally, the bulk of data collection occurred via semi-structured interviews of AA and DP integrated producers.

Interviewee selection was randomized; a list of all producers was obtained, each producer was assigned a number, and a random number generator was used to select about 40% of all producers as interviewees, allowing room for unreachable or unwilling producers, with the goal of interviewing about 1/3 of all producers. In some instances, producers that were not chosen for interviews were interviewed either: a) to ensure a representative sample in terms of geography and socioeconomic status; or b) simplify logistics when a chosen producer was particularly difficult to be reached. Interviews were continued until data saturation had been reached (when it seemed that the variety in responses had been captured and additional interviews were no longer yielding new information).

Semi-structured interviews were designed with the intent of understanding how producers’ lives had changed since they began working with AA or DP. Interviews typically lasted between 40 and 60 minutes, and were carried out following the Yale Human Research Protection Program guidelines. Before starting the interview, the research purpose was explained and producers were asked for verbal consent to participate. Producers were assured that responses would be reported anonymously, and their participation would not present them with any potential risks.

The interview questionnaire had four distinct sections. The first focused on relevant background information. This included characteristics and history of the property, such as size, forested area, registration in the Rural Environmental Registry (Cadastro Ambiental Rural, part of Brazil’s Forest Code), and how the producer obtained the property. This section also observed the origin of the producer’s partnership with AA or DP. The second was mainly oriented towards understanding environmental impact through questions related to productive economic activities, land use and income sources. The third section focused on social impact, with questions related to income level, financial stability, satisfaction with working with AA or DP, and overall quality of life.

Data analysis

Based on analysis of the data collected in the semi-structured interviews, social and environmental impact ratings were made for each company. Ratings ranged from Weak to Moderate to Strong. They were based on the analysis of specific indicators discussed in the Results. The social impact rating was most reliant on the self-reported ratings of overall quality of life, income level/purchasing power, and financial stability. The environmental impact rating was most reliant on the number of household engaged in slash-and-burn agriculture and the size of the herd for cattle ranching.

Results

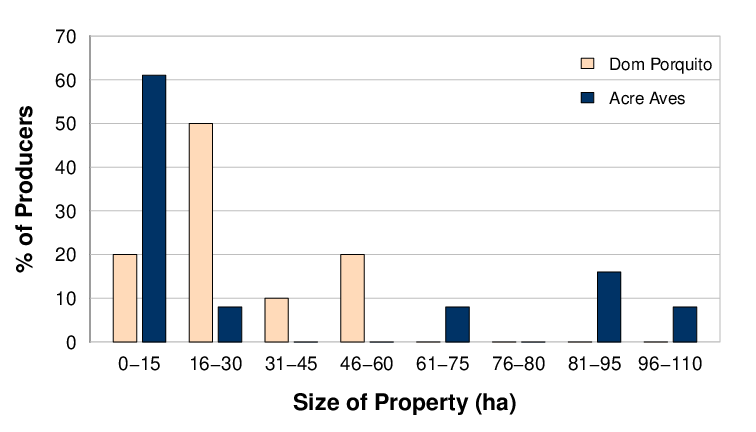

A total of 29% (13 of 45) of AA producers were interviewed, and 42% (10 of 24) of DP producers were interviewed. 62% of AA producers had properties up to 15 hectares (ha) in size and an average property size of 34 ha, while 70% of DP producers had properties up to 30 ha in size and an average property size of 27 ha (Figure 2).

The relatively small scale of the companies’ current supply chains resulted in a relatively small data set, which does not allow for quantitative cause and effect statements to be made with respect to the companies’ operations and observed differences in the lives of integrated producers. Accordingly, the data cannot prove or disprove the assumptions made in the impact model employed by AA and DP. However, the results demonstrate significant trends associated with the model, which can be used to support or oppose its underlying assumptions (see Table 1 for summary results).

| Impact | Acre Aves | Dom Porquito | ||

| Rating | Specific Indicators | Rating | Specific Indicators | |

| Social: | Strong | Overall quality of life: | Strong | Overall quality of life: |

| 100% reported moderate/significant improvement | 80% reported moderate/significant improvement | |||

| Income/purchasing power:1 | Income/purchasing power:1 | |||

| 62% made at least 3 significant investments | 40% made at least 3 significant investments | |||

| 92% made at least 2 significant investments | 50% made at least 2 significant investments | |||

| Financial stability:2 | Financial stability:2 | |||

| 92% previously reliant on agriculture | 80% previously reliant on agriculture | |||

| 46% previously reliant on daily contracting | 80% previously reliant on daily contracting | |||

| Env.: | Moderate | Slash-and-burn agriculture: | Weak | Slash-and-burn agriculture: |

| 92% of those previously reliant on agriculture stopped | 86% of those previously reliant on agriculture stopped | |||

| Cattle ranching: | Cattle ranching: | |||

| 43% increased herd size | 60% increased herd size |

Social Impact

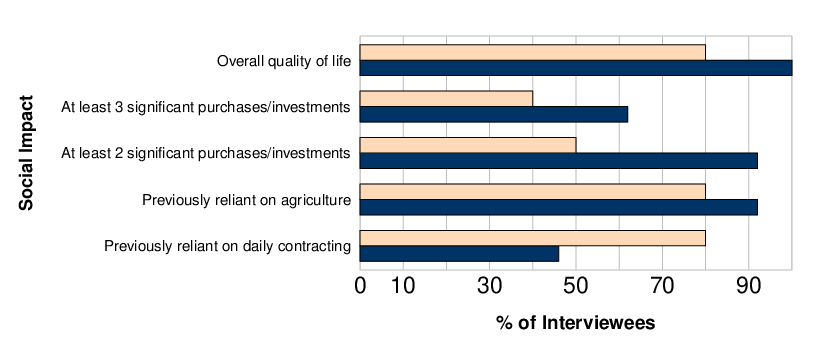

Overall quality of life The vast majority of AA and DP producers reported that they had experienced an overall improvement to quality of life, with 100% of AA producers and 80% of DP producers interviewed reporting a moderate or significant improvement (Figure 3). Many producers described a shorter and less physically taxing work day as compared to their previous form of income. For example, many producers used to rely predominantly on unmechanized agriculture, which required long hours working in the hot sun, versus fewer hours per day tending to the animals in the shade of the barn. Another common benefit reported was the ability to work at home and remain close to family, as many producers used to spend long stretches (up to 20 days per month) away working as daily contractors on large ranches. However, a small number of producers reported worsened quality of life, citing things such as bad odor from the barn, the lack of days off (as the animals require daily attention), company delays in delivering new stocks of animals, and the burden of debt that came with the installation of the barns for most producers.

Income level Due to the complexity of measuring rural household incomes (see Discussion), a direct estimate of change in household income was not assessed for all producers. However, all producers of both AA and DP who could give an estimate of monthly income reported increases, some of which were modest while others were up to 300%. Although the accuracy of these numbers is questionable, they suggest that average income levels did rise.

Many producers reported that previously they never had spare money beyond what was needed for basic essentials. The majority reported having made significant purchases or investments on their property (such as buying a new car, building a new house, installing a new well, etc) since becoming integrated producers (Figure 3). 62% of AA producers and 40% of DP producers reported making at least three such investments since becoming integrated producers. Furthermore, 92% of AA producers and 50% of DP producers made at least two such investments. These figures suggest a strong trend of increasing purchasing power after entering AA’s or DP’s supply chain, particularly among AA producers.

Stability of income All but one producer interviewed reported reliance on a variety of income sources both previously and after beginning to work with AA or DP. According to the interview results and observation, it is very uncommon for producers to rely on only one economic activity. Furthermore, most integrated producers had previously been reliant on agriculture and daily contracting, which are both highly unstable income sources that lead to significant income volatility, unlike working with AA or DP (see Discussion). Of the AA producers interviewed, 92% reported previous reliance on agriculture and 46% reported previous reliance on daily contracting on other ranches. 80% of DP producers previously relied on agriculture and 80% also relied on daily contracting. Thus, there is a clear trend of increased financial stability associated with becoming an integrated producer.

Environmental Impacts

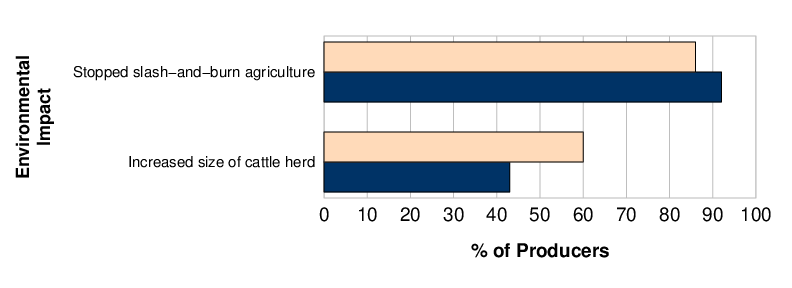

Forest conversion for agriculture As stated above, the majority of producers previously relied heavily on agriculture as a source of income prior to working with AA or DP. All but one producer used unmechanized agriculture, which necessitates the clearing of forests for additional pasture ever two to three years, as previous pasture becomes degraded due to the region’s poor soils. Of the 92% of AA producers who previously practiced unmechanized agriculture, 92% stopped either prior to or upon becoming integrated producers (Figure 4). Of the 70% of DP Producers who previously practiced unmechanized agriculture, 86% stopped. Furthermore, several producers commented one of the additional benefits of working with AA and DP being that the work did not require the clearing of forests, as was previously needed in order to survive.

Forest conversion pressure from cattle ranching A total of 46% of AA producers and 70% of DP producers reported previous reliance on cattle ranching. As income levels of integrated producers rose, many chose to invest in their cattle herd. 43% of AA producers and 60% of DP producers expanded the size of their cattle herd since the start of their work with AA and DP, potentially contributing to continued degradation of cleared pastures and increasing pressure for further conversion of the region’s forests to pasture (Figure 4). Many producers reported that they had started selling more cattle each year than previously, suggesting that the increased income from becoming integrated producers had allowed them to make their cattle ranching operation more profitable.

Financial Performance

A brief commentary on the financial performance of the enterprises is warranted, as it provides insight into the long-term sustainability of the companies as well as their associated social and environmental impacts. Based on conversations with Kaeté staff, it appears as though both companies are performing below expectations. The processing facilities of both companies are operating at very low capacity utilization, thus generating low return on asset values. DP’s slaughterhouse is currently operating at about 11% of its maximum capacity, while AA is operating at about 48% of its maximum capacity. There are two main issues contributing to these bottlenecks. First, the companies lack the working capital needed to increase operations to a level that is efficient given the large scale of the production facilities. Second, the underlying productive base supplying the slaughterhouses is not large enough: the piglet production center needs to be enlarged, and more barns to raise both chickens and pigs are needed, but there has been difficulty attracting investors to invest in these earlier stages of the supply chain.

Discussion

As an initial study observing the results of two impact investments in the Brazilian Amazon, valuable takeaways can be distilled from the results. This is especially true because to the author’s knowledge, there have been no peer-reviewed studies examining the effects of impact investing in tropical forest regions. Observed results suggest the AA and DP are achieving strong social impact. While positive environmental impacts are evident, they are more tenuous.

The social impact of both AA and DP was rated as Strong. The majority of integrated producers reported better quality of life and higher income. Many significantly improved their living conditions and homes, and were able to make significant investments on their property. While the results do not demonstrate a direct causal link between becoming an integrated producer and increased purchasing power, they suggest that becoming integrated within AA or DP allows rural producers to make investments that would not otherwise be possible. Furthermore, many interviewees expressed a desire to expand their production systems for further improvement. The AA/DP model also allowed households to increase their degree of financial stability by reducing month-to-month variation in income. The model is not meant to be a standalone income source, but one that provides a stable, base level of income that is complemented by other productive activities. Most producers reported a previous reliance on agriculture and daily contracting, which are both unstable and volatile. Income from agriculture depends heavily on the weather and market prices, and many producers reported either past production losses due to bad weather and/or difficulty selling produce in the market. Daily contracting is perhaps even more unstable an income source, with the majority of producers reporting high variability in the amount of daily contracting work they can find each month. On the other hand, becoming an integrated producer of AA or DP provides a stable and predictable income source that can serve as a core component of household income, allowing more unpredictable activities to provide complementary income. Thus, it is evident that becoming an integrated producer was also important in increasing the month-to-month financial stability of integrated producers.

The environmental impact of AA was rated as Moderate, while the environmental impact of DP was rated as Weak. A very strong trend was observed between becoming an integrated producer and reduced deforestation associated with unmechanized agriculture, which contributed positively to the environmental impact rating. However, this was reduced by another strong trend observed between becoming an integrated producer and increasing the size of one’s cattle herd. This is a particularly interesting point, because cattle ranching is associated with the majority of deforestation in the Amazon (Nepstad et al. 2009), and increases in herd sizes represent a negative environmental impact. However, in this case it also represents a positive social impact. In Acre, cattle are one of the safest investments small and medium landowners can make, primarily because they are extremely liquid because of the region’s strong cattle market. This suggests that in sustainable development, oftentimes tradeoffs must be made between social and environmental progress, and win-win outcomes cannot always be achieved.

There are several additional points that are relevant to the environmental impact of AA and DP, that call into question the assumptions underlying the impact model. Based on interview results and observation, in recent years the government has significantly ramped up enforcement of Brazil’s Forest Code and other environmental regulations. Many producers reported that clearing additional forest on their lands was no longer possible for any rural land owners in the region because of increased governmental monitoring and enforcement in the form of fines. This suggests that AA and DP integrated producers may have been forced to stop clearing their lands of forests either way. Second, while some interviewees did have large areas of forest cover remaining on their properties, many had very small areas of forest remaining. Thus, the potential for continued deforestation on those properties is minimal, which makes assessing the model’s impact on deforestation more challenging.

It is worth mentioning that the ratings explained above are not indicative of the scale of impacts realized. AA only has 45 integrated producers and DP only has 24. Thus, the direct impacts of the companies’ supply chains are relatively limited, reaching under 70 rural landowners who typically have properties under 50 hectares in area. The investments made to achieve this impact are large but not exceedingly so: AA has received total equity investments of US$10 million, while DP has received US$25 million. However, these numbers do not include the separate investments made by the government in partially financing the barns for producers. Furthermore, the scale of impact could be greatly increased (about two times for AA and nine times for DP, considering unused capacity in the slaughterhouses) if additional investments are made and the companies are able to operate efficiently.

As discussed in the Introduction, the majority of Amazon deforestation is driven by cattle ranching (Nepstad et al. 2009). In recent years, a large part of international conservation efforts have focused on reducing further deforestation from cattle ranching by intensifying production on existing pasture. The assumption underlying these actions is similar to the assumption underlying AA’s and DP’s environmental impact model. That is, that intensifying production on lands that have already been deforested will reduce deforestation pressure on remaining forests. The results on this study show that in the case of AA and DP, this link may not be as strong as was assumed. Although this study doesn’t disprove this assumption, it does demonstrate that such assumptions regarding the relationship between intensification of production and reduced deforestation merit further qualification and analysis, especially given the large amount of the scarce financing for conservation that is being poured into this area.

While the results yielded significant trends and clear takeaways, the analysis undertaken presented significant intricacies that require further investigation than was allowed for in this project. The complexities of rural household incomes are not insignificant, and demand a more in-depth analysis with a larger sample size to achieve results that are accurate as well as quantifiable. Furthermore, AA and, especially, DP are still relatively young companies, and have not reached a point of equilibrium or long-term stability. Many of the integrated producers are also still paying off loans that were used to finance a portion of the barns installed on their property. Although these loans place a heavy burden on the producers, all producers were confident in their ability to meet the ongoing requirements of their loans and fully pay them off within several years. Once those loans are paid off, a more comprehensive assessment of the effects of their work with AA or DP will be possible. Lastly, an in-depth analysis of the financial performance of the companies would be an ideal addition to this study, to truly gauge how sustainable the business models are and how sustainable the impacts will be in the future.

Despite these limitations, this study suggests that impact investing can be an effective solution for sustainable development in tropical forest environments. The results indicate a strong positive trend between inclusive supply chain and increased financial security and quality of life for rural populations in Acre. While the environmental outcomes were not as clear, the results do suggest a positive trend between inclusive supply chains and reduced deforestation through the reduction of unsustainable slash-and-burn agriculture. However, by increasing rural incomes and giving landowners access to more resources which can be used for unsustainable economic activities, the AA/DP model may also indirectly promote deforestation. The same thing might be said of other conservation efforts in the Amazon attempting to intensify economic activity to reduce deforestation.

Acknowledgements

I would like to thank Dr. Florencia Montagnini, who served as my primary advisor and made significant contributions in guiding the research project throughout its duration. I would also like to thank my secondary advisor, Dr. Amity Doolittle, who provided valuable input particularly to data collection and analysis. Furthermore, I would like to thank Kaeté Investimentos, Acre Aves, and Dom Porquito, for without their support and facilitation this research would not have been possible. Last but not least, I would like to thank the 22 families who graciously allowed me into their homes and took time out of their day to participate in my interviews.

References

Bonan, G. 2008. Forests and climate change: Forcings, feedbacks, and the climate benefits of forests. Science 320, 1444–1449.

Convention on Biological Diversity (CBD). 2018. Strategic Plan for Biodiversity 2011-2020, including Aichi Biodiversity Targets. Retrieved from: https://www.cbd.int/sp/

Chepkemoi, J. 2017. The Richest and Poorest States of Brazil. Retrieved from: https:// www.worldatlas.com/articles/the-richest-and-poorest-states-of-brazil.html

Clark, S. 2007. A Field Guide to Conservation Finance. Island Press, Washington, DC, USA.

Food and Agriculture Organization of the United Nations and European Commission Joint Research Centre (FAO & JRC). 2012. Global Forest Land-Use Change 1990–2005. Food and Agriculture Organization of the United Nations, European Commission Joint Research Centre. FAO Forestry Paper No. 169. FAO, Rome, Italy.

Global Impact Investing Network (GIIN). 2018. About Impact Investing. Retrieved from: https://thegiin.org/impact-investing/

Huwyler, F., Käppeli, J., Serafimova, K., Swanson, E. and Tobin, J. 2014a. Conservation Finance: Moving beyond donor funding toward an investor-driven approach. Credit Suisse, WWF, McKinsey & Company, Zurich, Switzerland.

Martin, C. 2015. Conservation Finance 101. Conservation Finance Network. Retrieved from: https://www.conservationfinancenetwork.org /conservation-finance-101

NatureVest & Eko Asset Management Partners. 2014. Investing in Conservation: A landscape assessment of an emerging market. NatureVest & Eko Asset Management Partners.

Nepstad, D., Soares-Filho, B. S., Merry, F., Lima, A., Moutinho, P., Carter, J., …, Stella, O. 2009. The end of deforestation in the Brazilian Amazon. Science 326, 1350–1351.

O Governo do Estado do Acre. 2018 Acre em Números. Rio Branco, AC: O Governo do Estado do Acre.

Parker, C., Cranford, M., Oakes, N., & Leggett, M. 2012. The Little Biodiversity Finance Book. The Global Canopy Programme, Oxford, UK.

Rêgo, J.F. 2015. Acre, o Voo da Águia. Rio Branco, AC.

Sanchez, P.A., Bandy, D.E., Villachica, J.H. & Nicholaides, J.J. 1982. Amazon basin soils: Management for continuous crop production. Science 216, 821–827.

Sloan, S. & Sayer, J. 2015. Forest resources assessment of 2015 shows positive global trends but forest loss and degradation persist in poor tropical countries. Forest Ecology and Management 352, 134–145.

Soares-Filho, B.S., Nepstad, D.C., Curran, L.M., Cerqueira, G.C., Garcia, R.A., Ramos, C.A., …, Schlesinger, P. 2006. Modelling conservation in the Amazon basin. Nature 440, 520–523.

Watling, J., Iriarte, J., Mayle, F.E., Schaan, D., Pessenda, L.C., Loader, N.J., …, Ranz, A. 2017. Impact of pre-Columbian “geoglyph” builders on Amazonian forests. PNAS 114, 1868–1873.

-

Chris is a third-year joint Master of Business Administration and Master of Forestry candidate. He is interested in natural resource management, timberland investments, conservation finance, and developing markets. While at Yale, he has held positions with the Yale School Forests, J.P. Morgan Chase & Co. and Klabin S.A. (Brazil’s largest pulp and paper producer). Prior to Yale, Chris worked as Program Associate of the Andes-Amazon Initiative at the Gordon and Betty Moore Foundation. He graduated summa cum laude in Environmental Studies from the University of Colorado at Boulder in 2012. Chris is from Connecticut, but has spent over a decade living in South America, Europe, and Asia. Chris is fluent in Portuguese and proficient in Spanish. He is an avid trail-runner, amateur piano-accordionist, and mediocre salsa dancer.↩

-

For simplicity’s sake, the AA operation is described. DP employs essentially the same model, except it includes approximately 25 integrated producers, who fatten pigs over the course of about 105 days until an average weight of 105 kilograms.↩